While practicing social distancing and COVID-19 pandemic guidelines, you can still send money to your loved ones wherever, whenever through eGiveCash. Sending and receiving cash is now made easier, with over 500 Security Bank eGiveCash-enabled ATMs to received money from. Click here for a list of operational ATMs.

NEW FEATURE: You can now use eGiveCash to your own mobile number, making sending money even easier!

But before you can use eGiveCash, you need to enroll your account to Security Bank Online. If you’re not yet enrolled, click HERE.

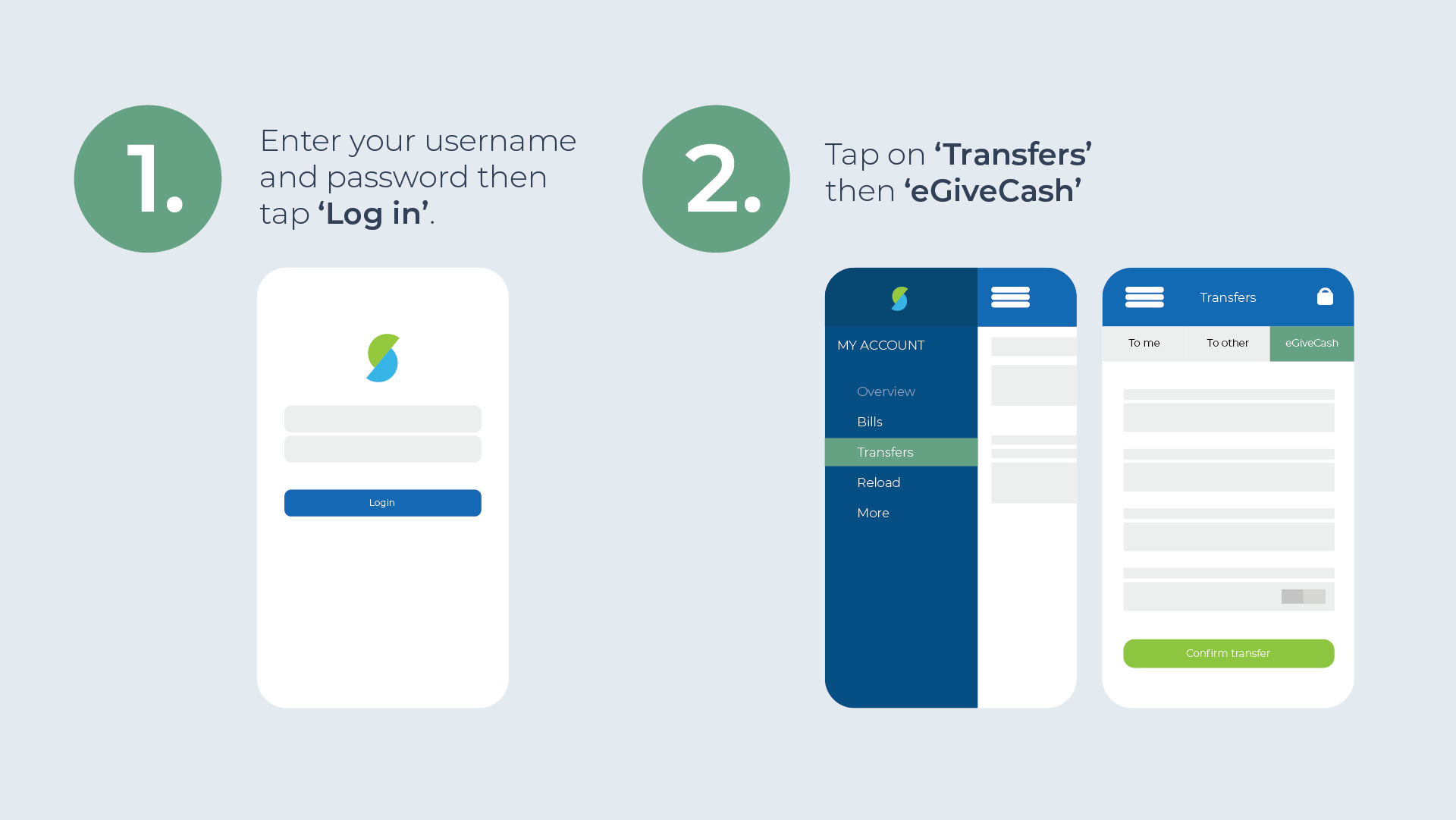

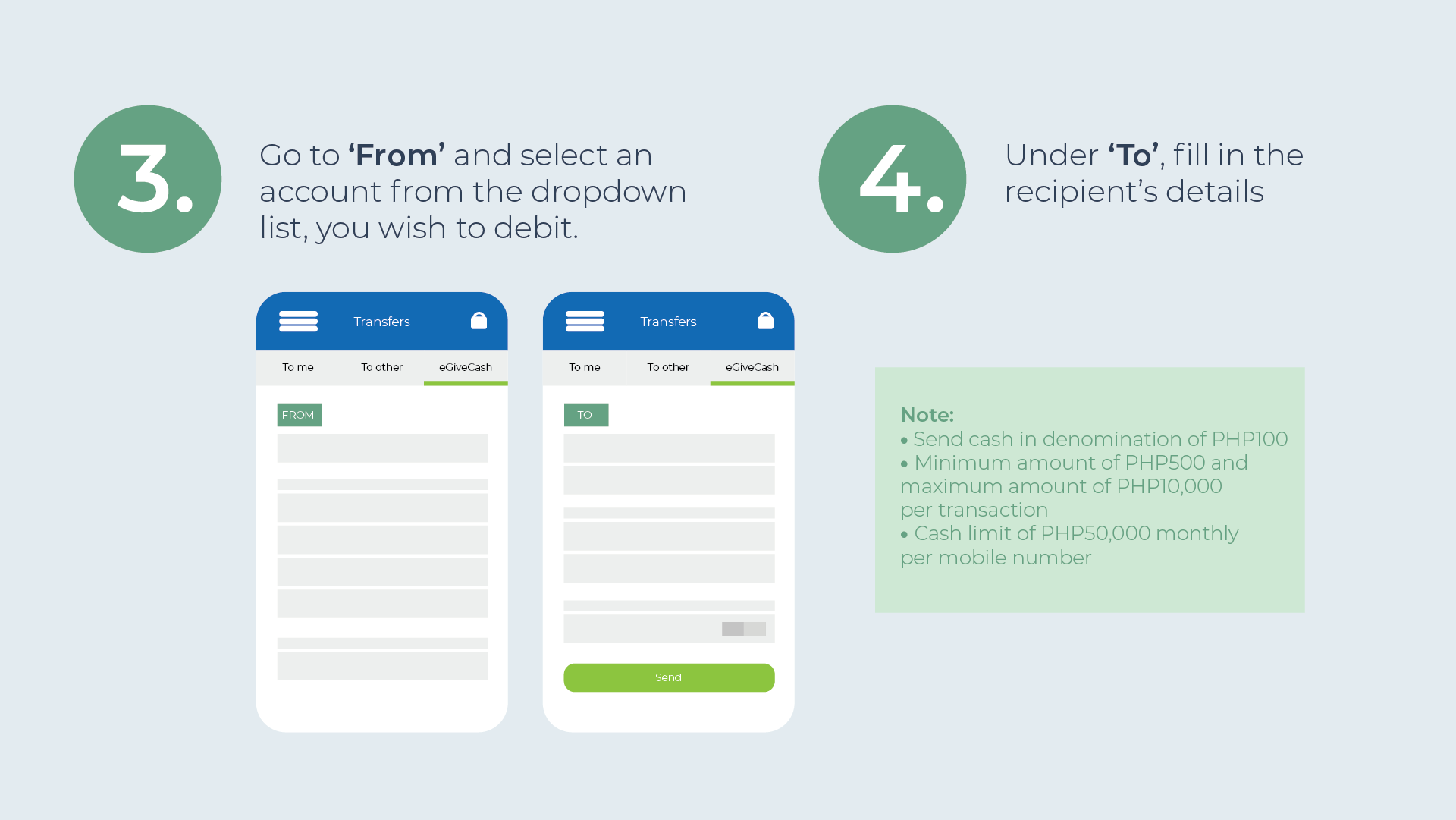

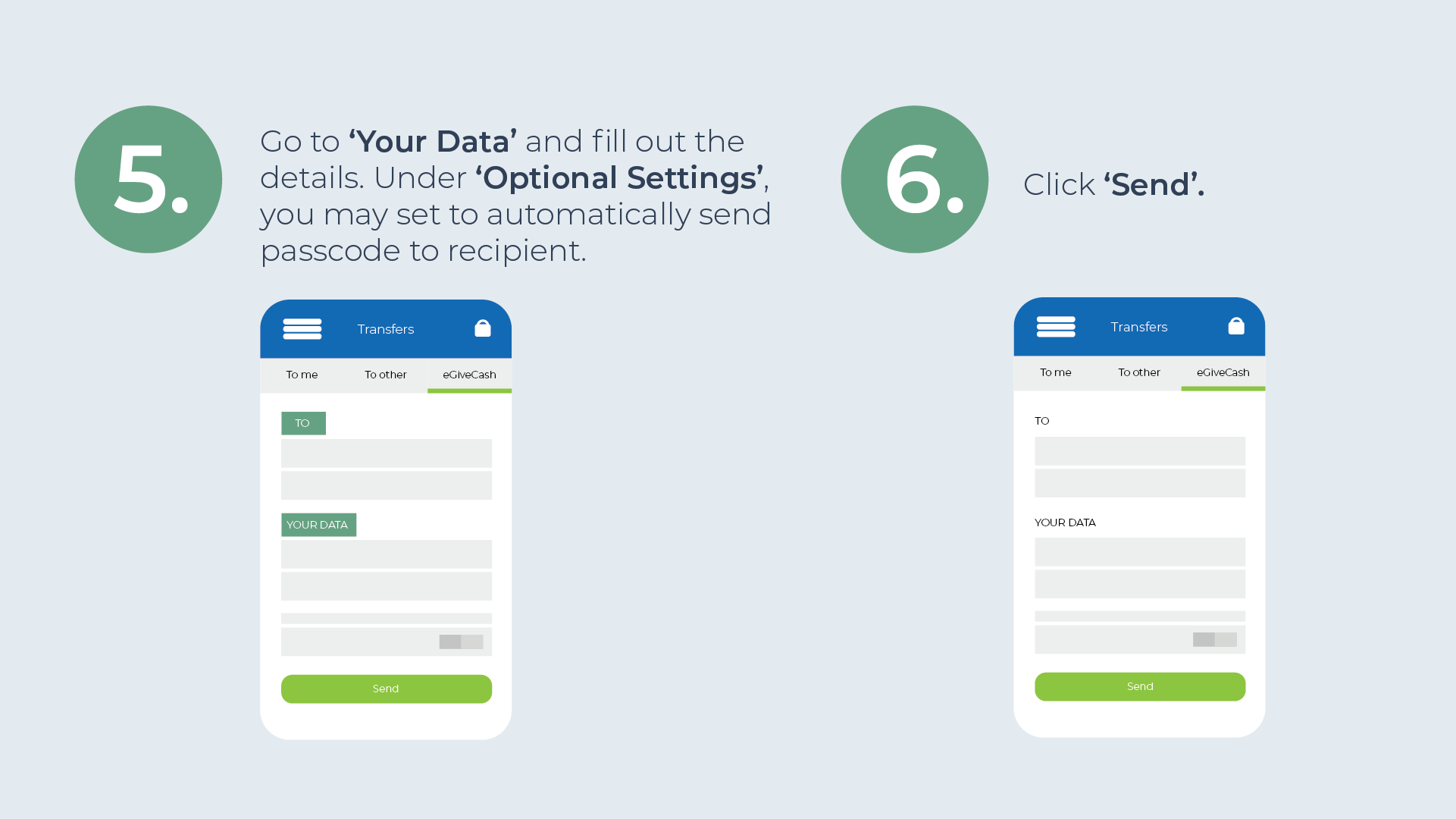

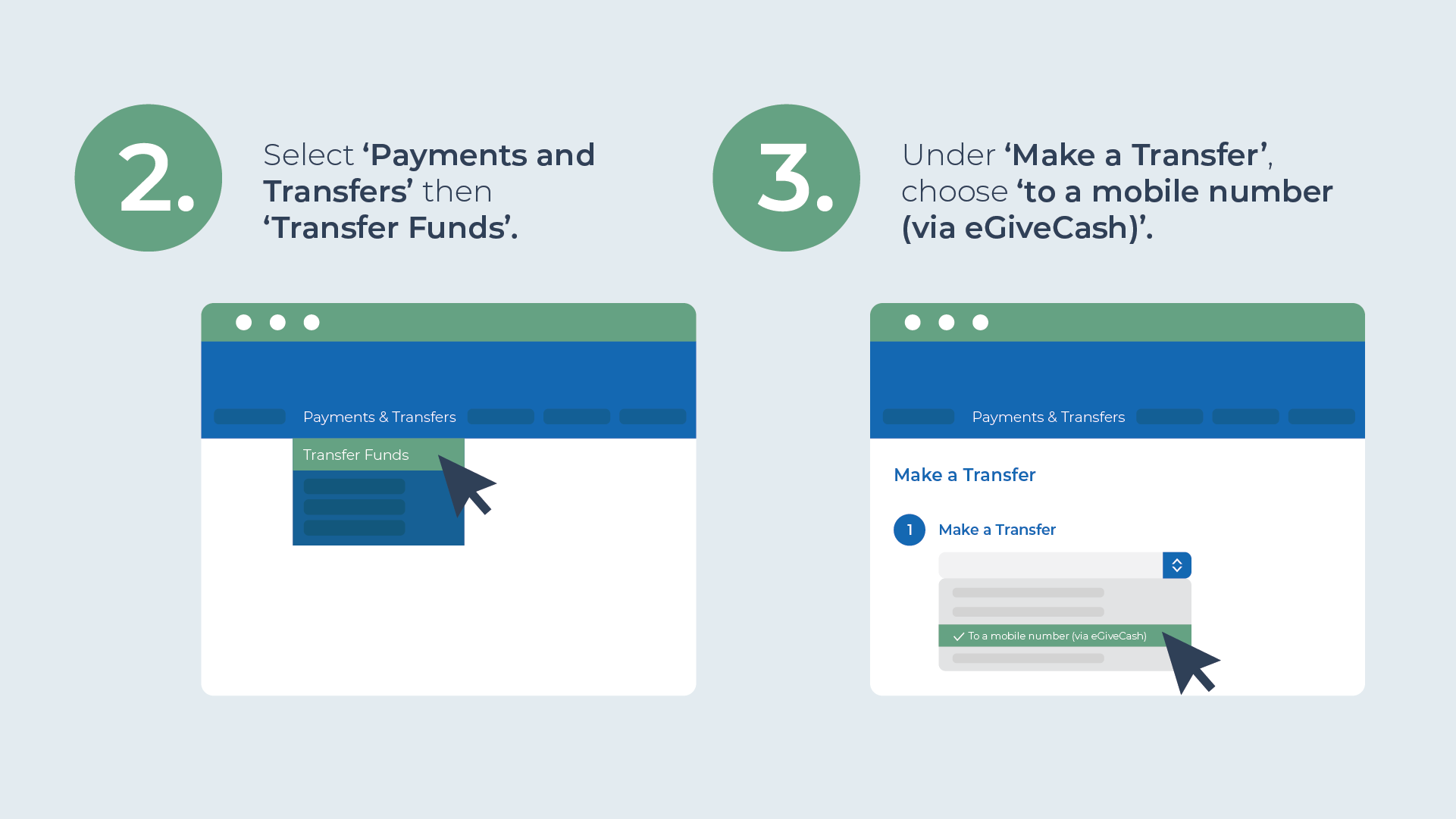

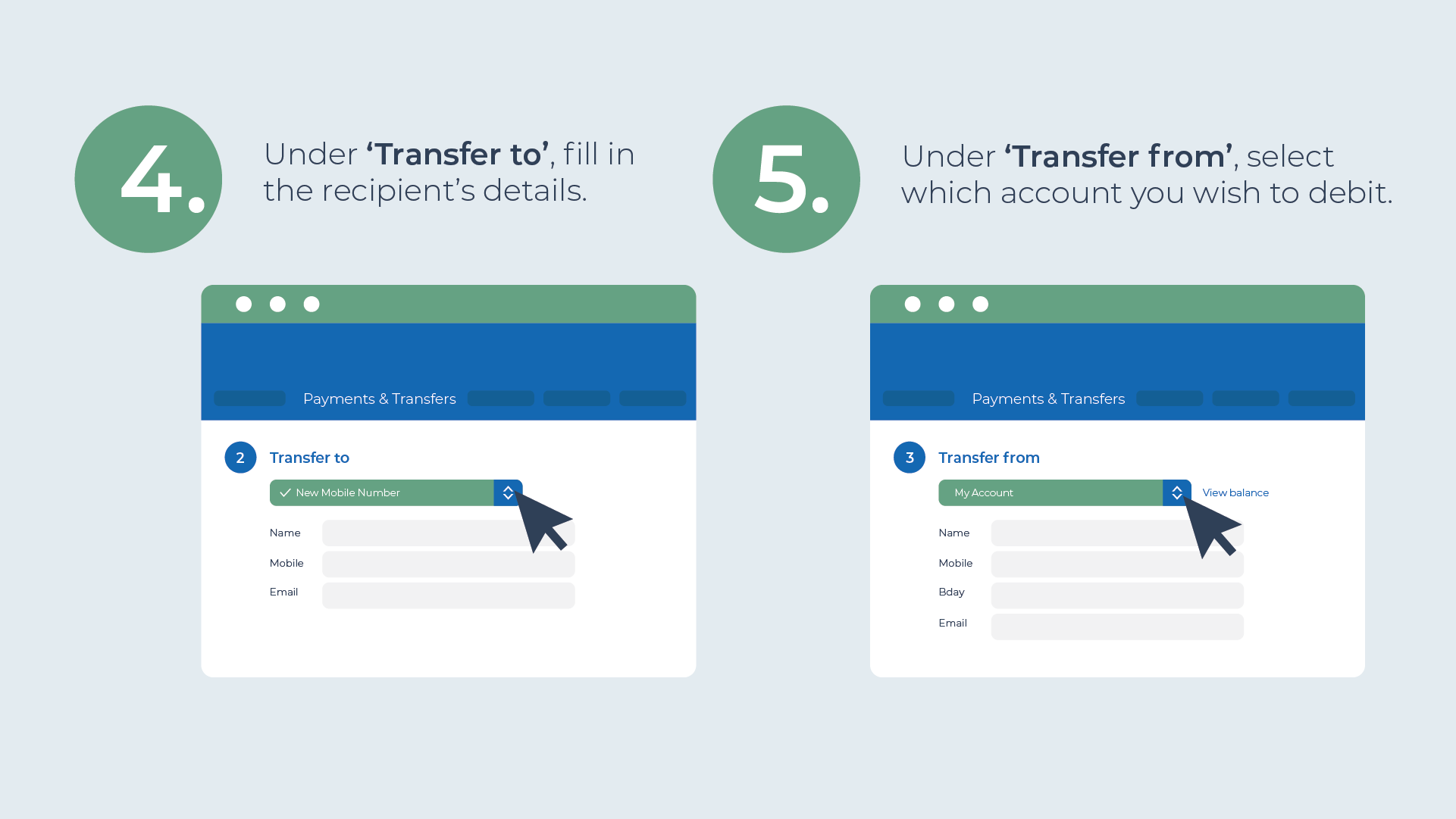

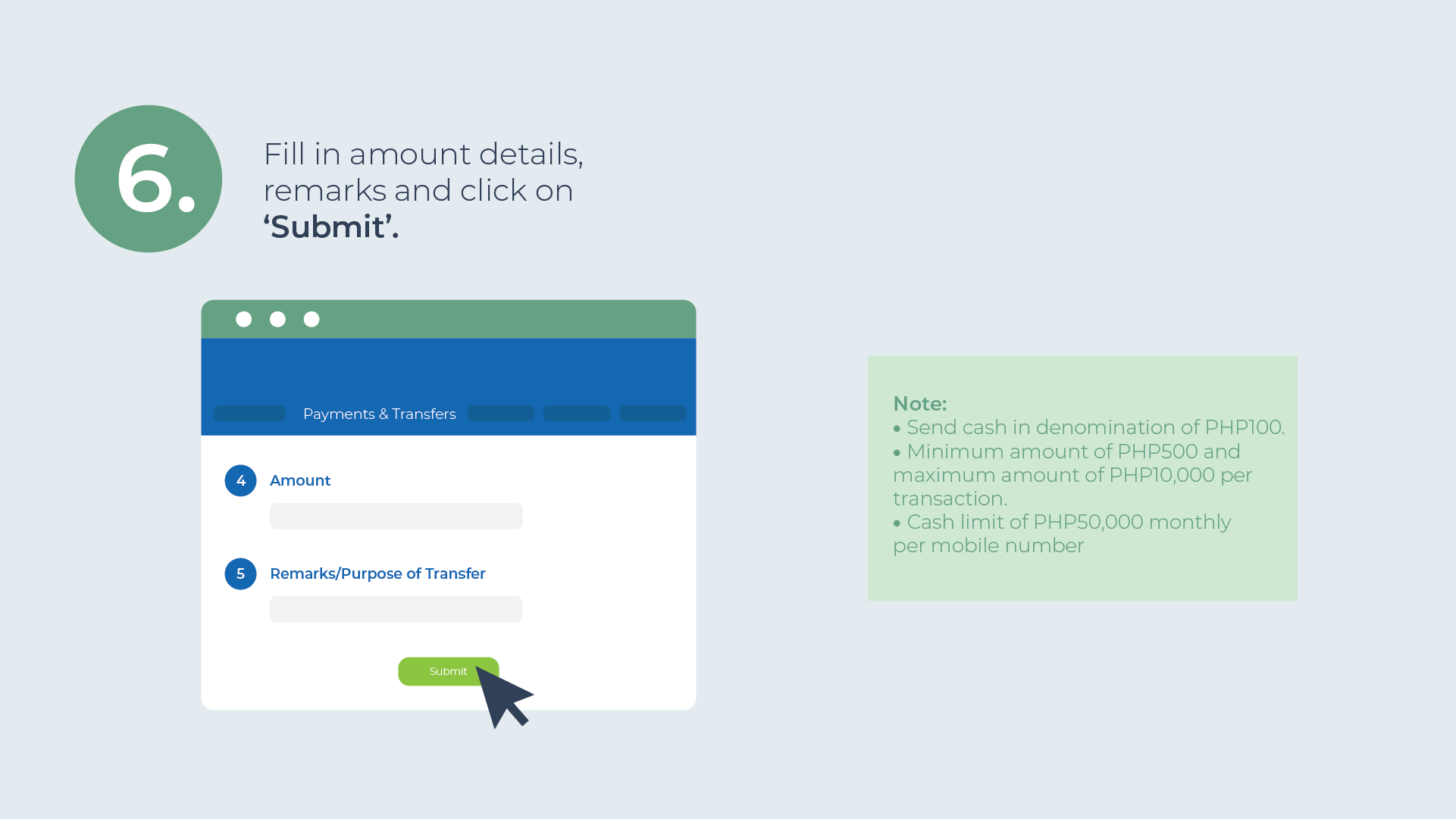

Now, here’s a step by step guide on how to use eGiveCash:

Through Security Bank Mobile App

Note: You can send from P500 up to P10,000 per transaction (in denomination of P100). Please note that there is a monthly cash limit of P50,000 per mobile number.

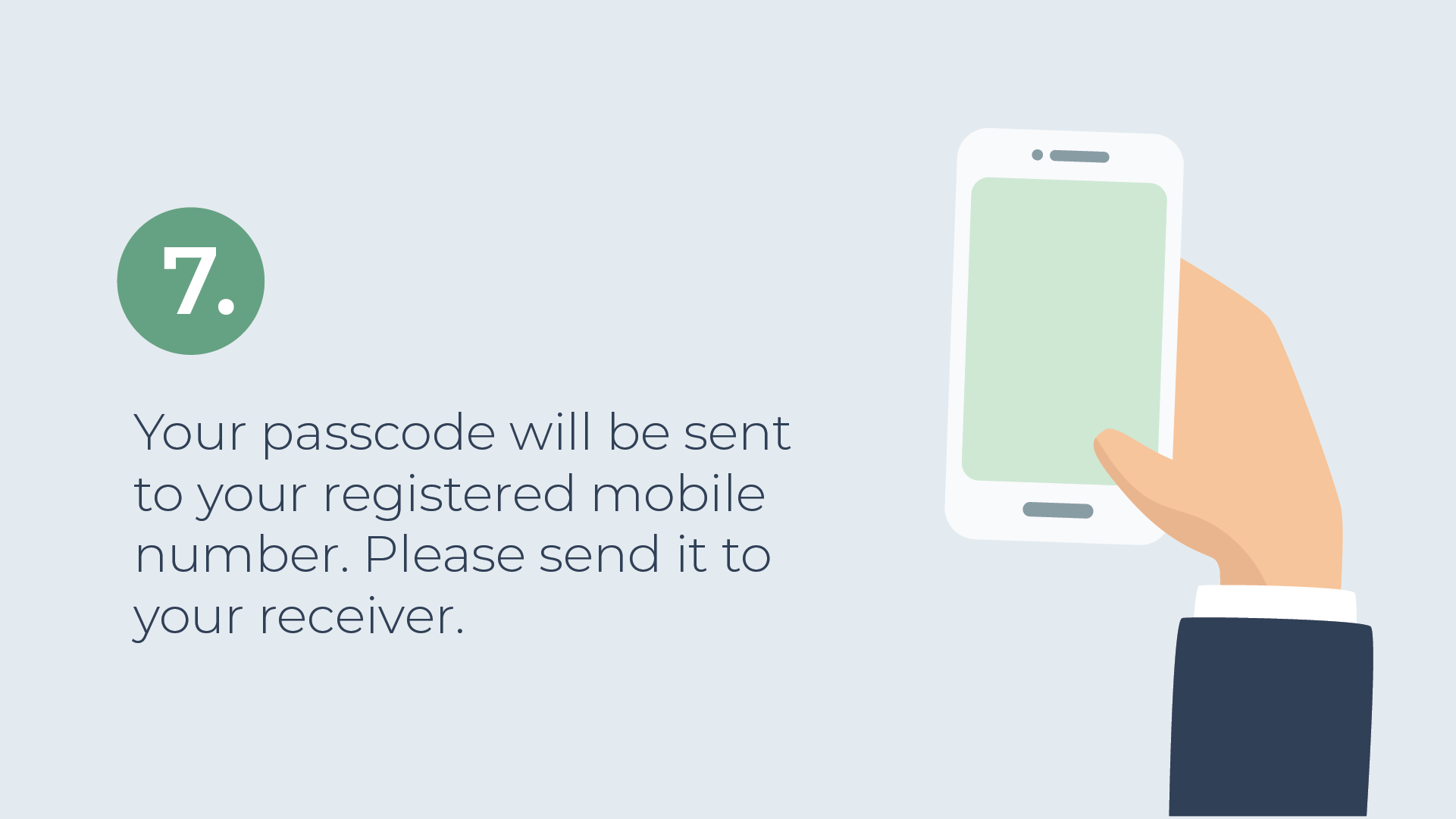

Notify the receiver that you are done. The receiver may now go to the nearest Security Bank ATM with eGiveCash to pick up the cash.

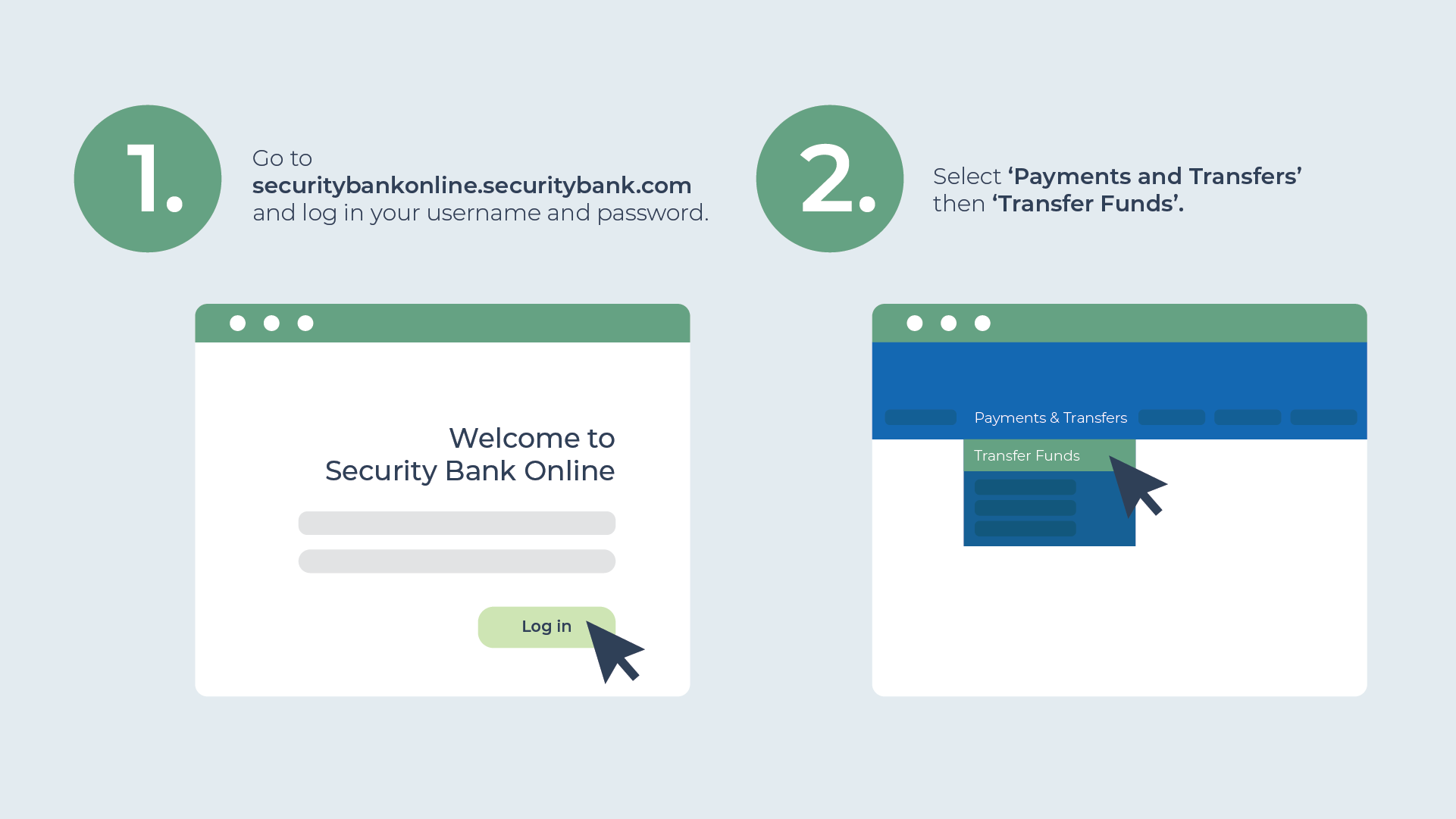

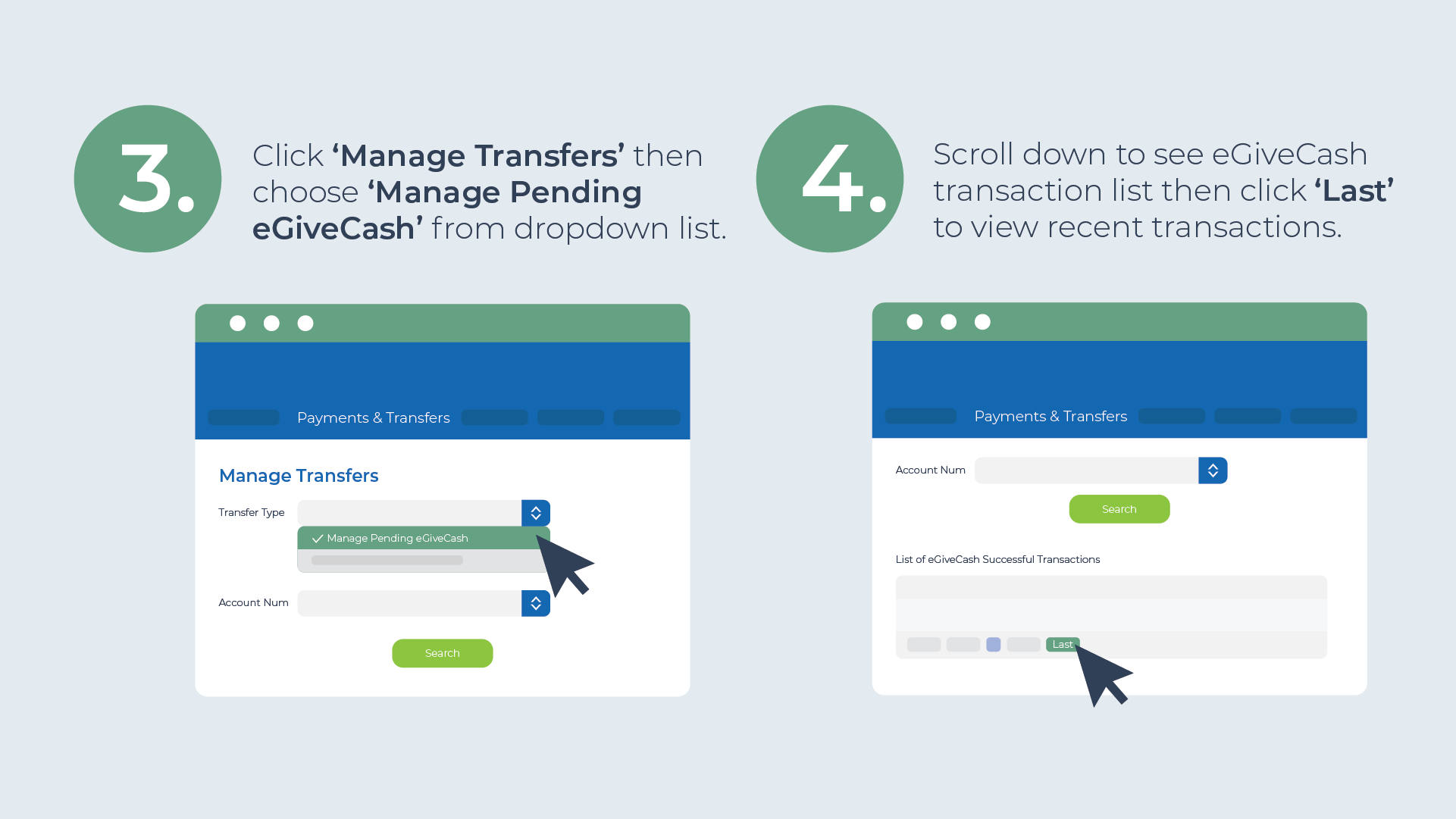

Through Security Bank Online

Note: You can send from P500 up to P10,000 per transaction (in denomination of P100). Please note that there is a monthly cash limit of P50,000 per mobile number.

Notify the receiver that you are done. The receiver may now go to the nearest Security Bank ATM with eGiveCash to pick up the cash.

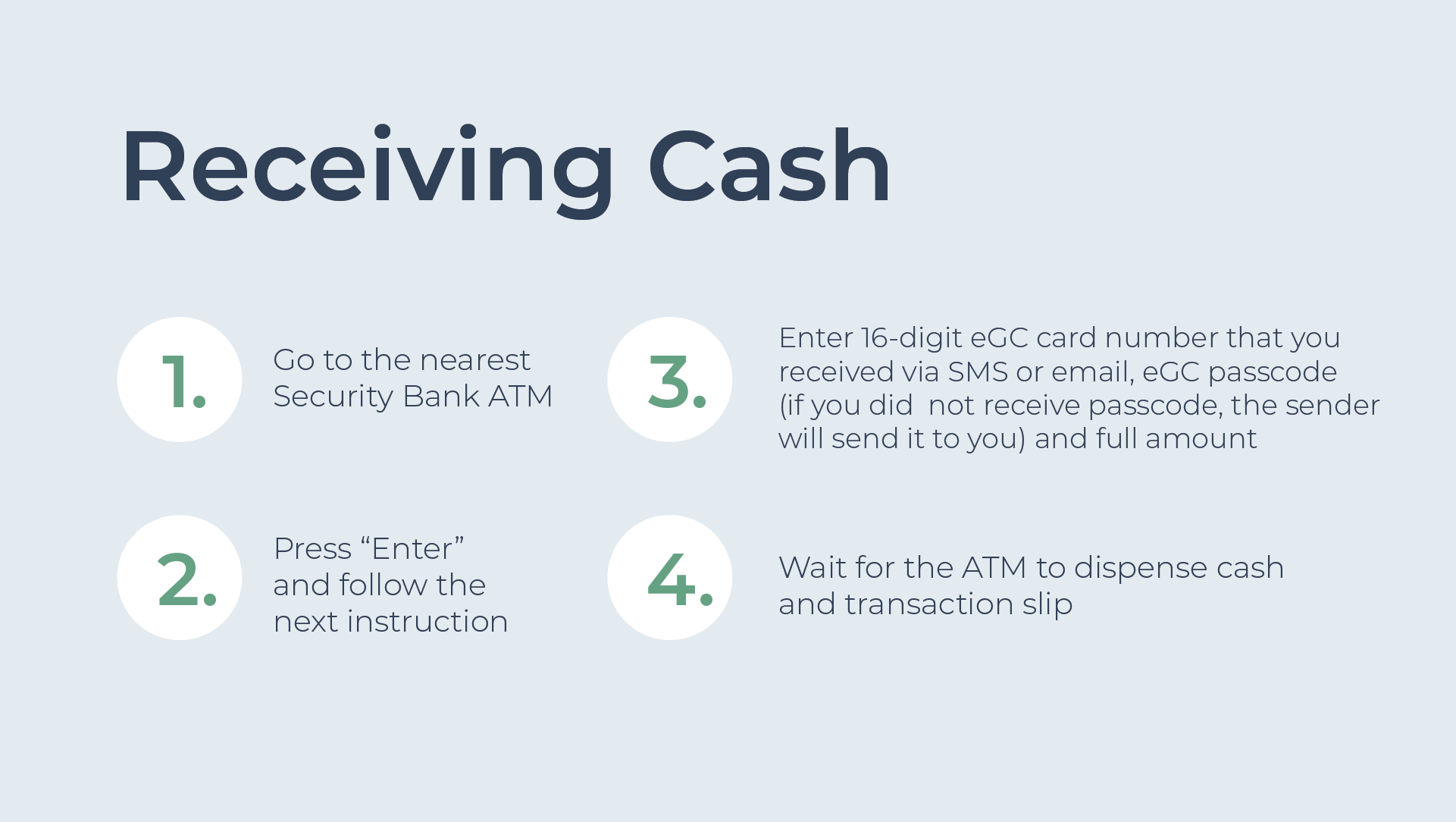

How to Claim

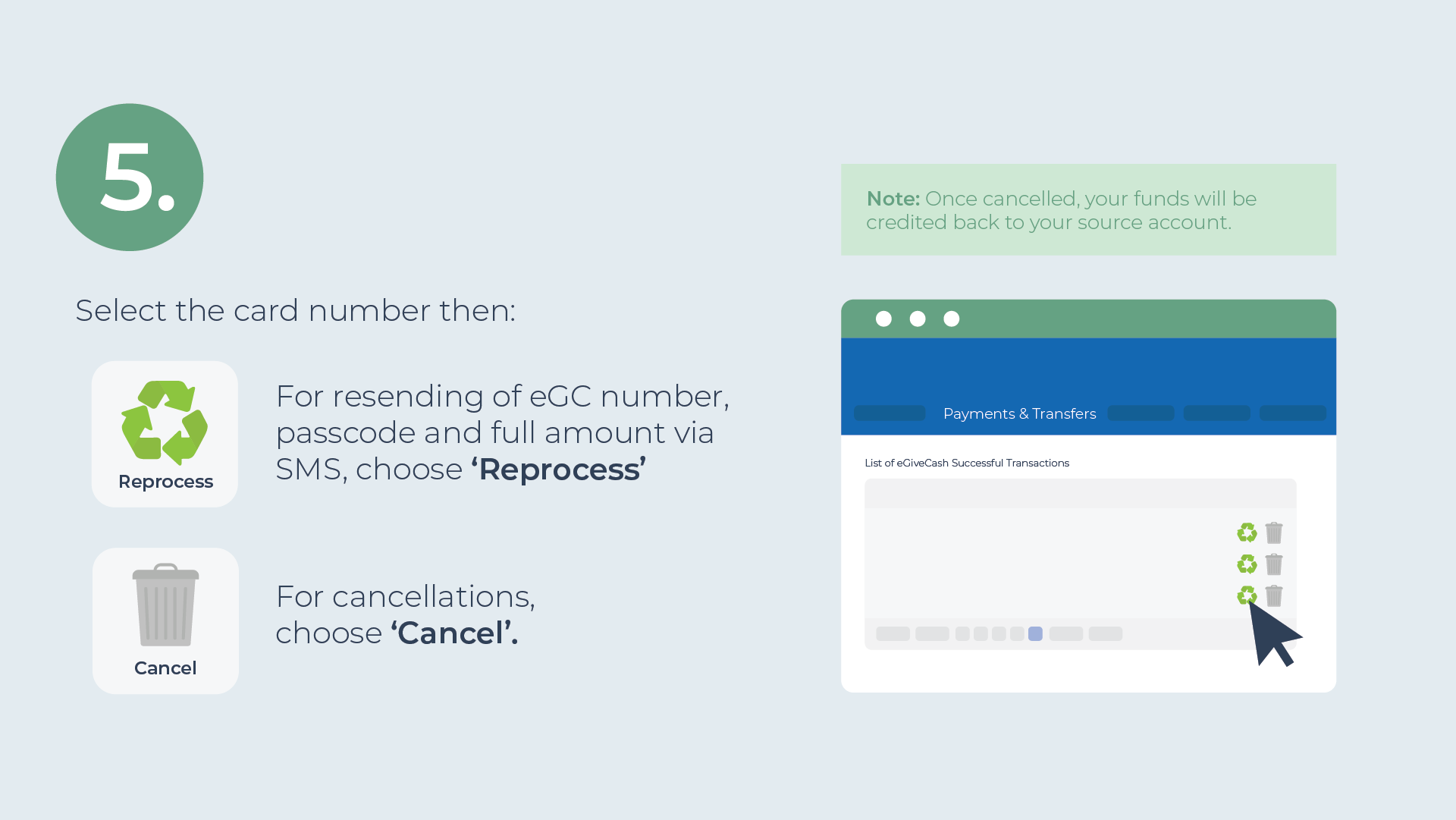

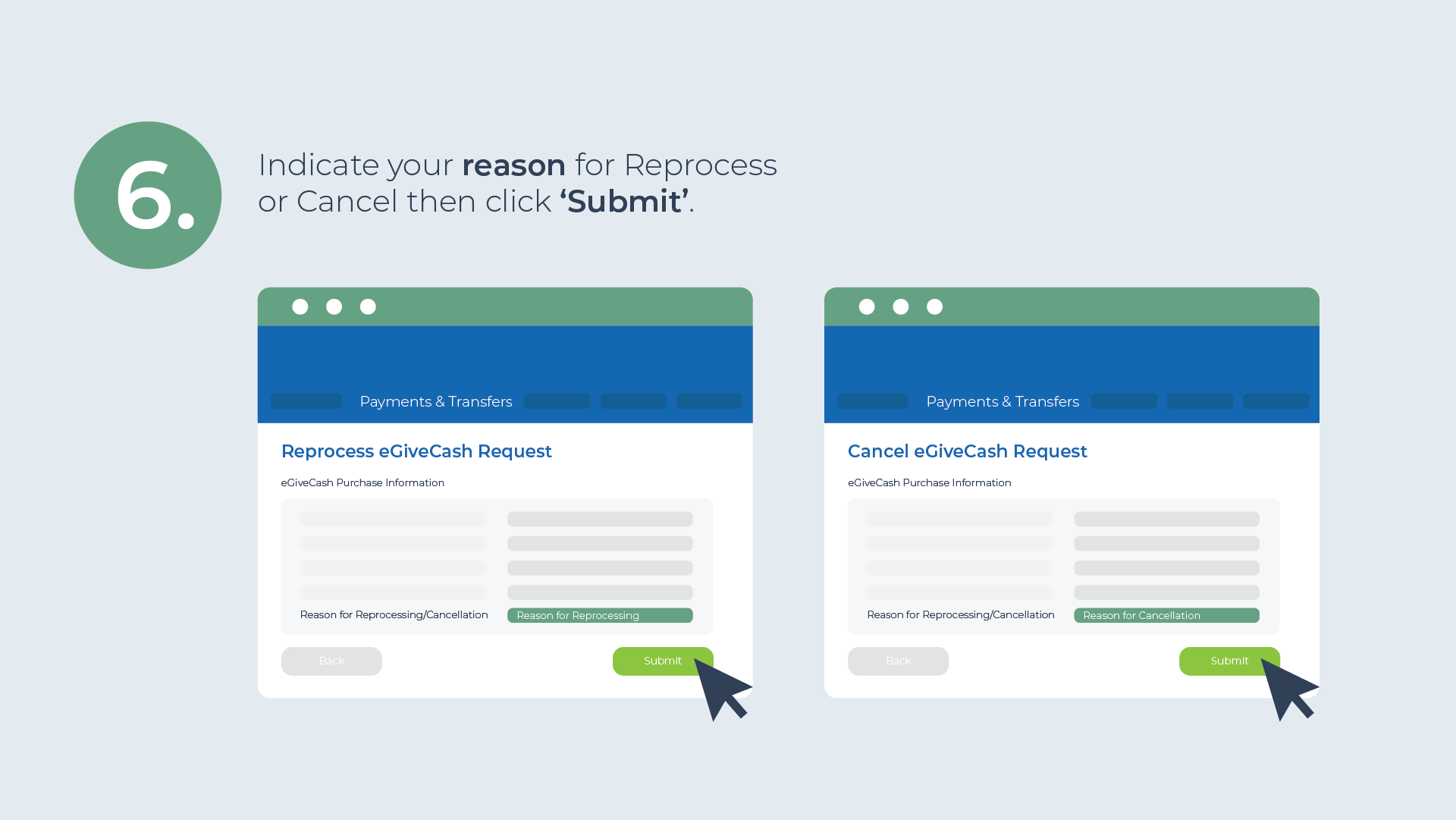

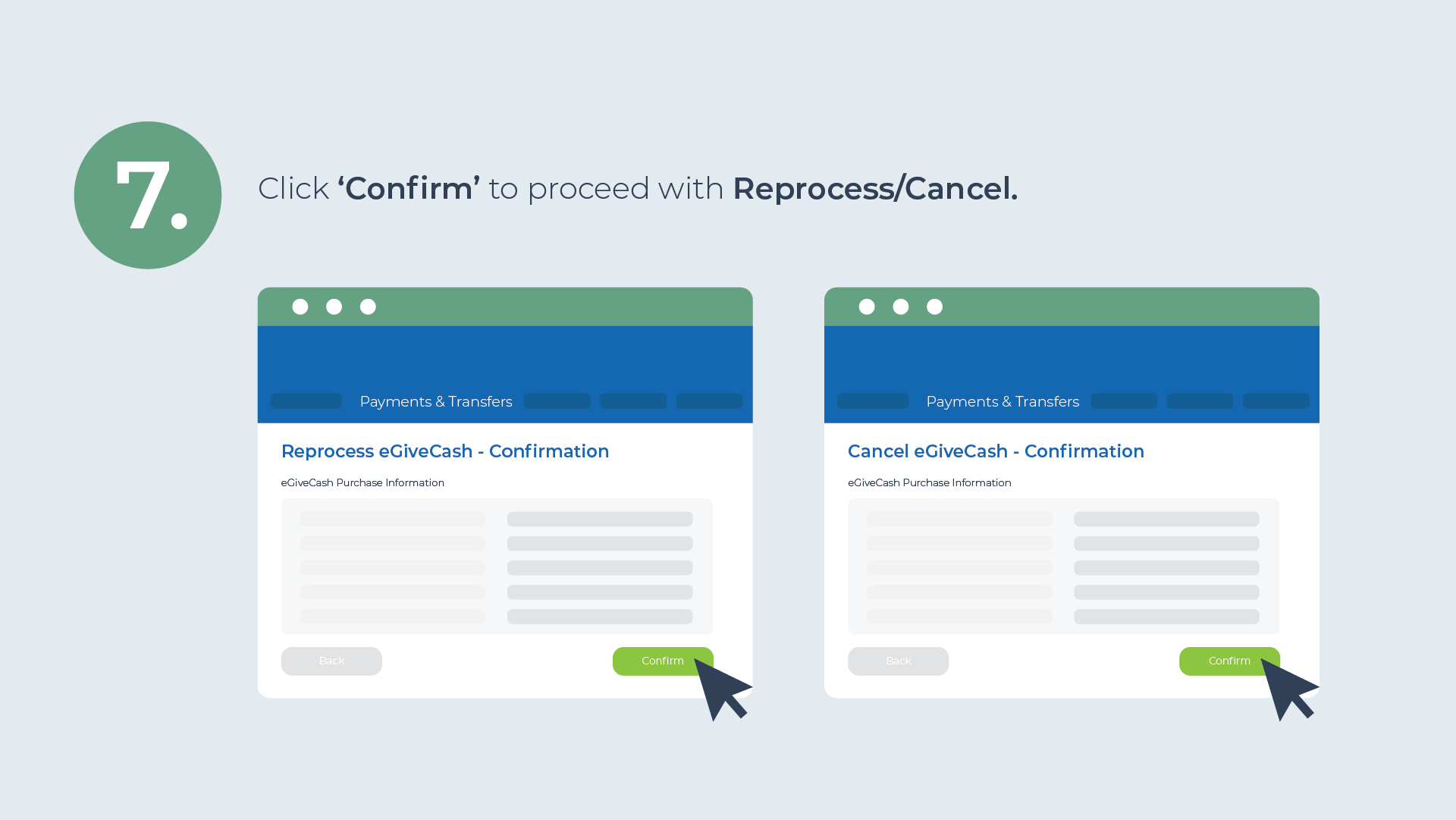

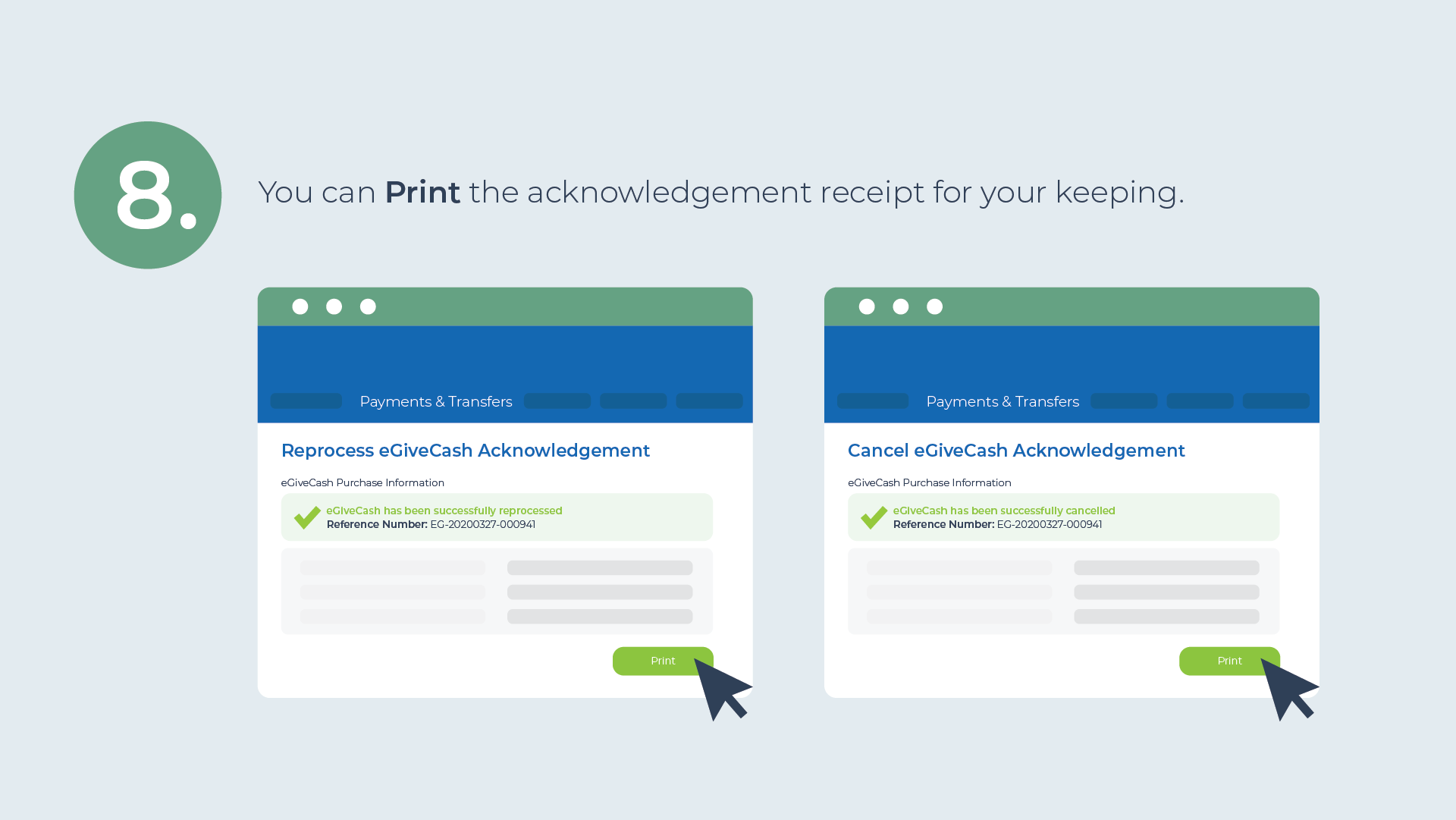

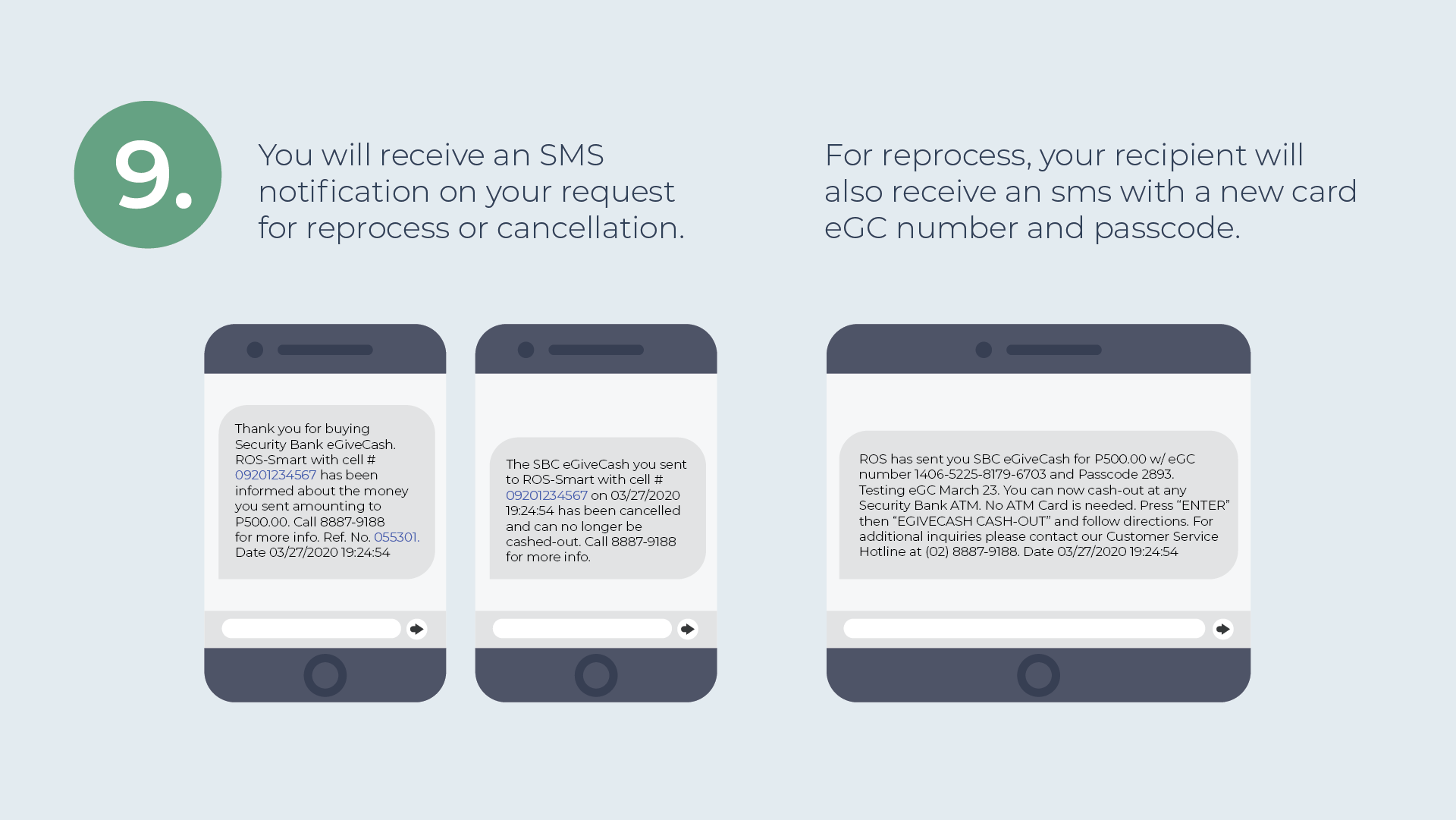

Need to Cancel or Reprocess?

Through Security Bank Online, you can:

- Cancel eGiveCash transaction if you have mistakenly sent eGiveCash to the wrong number or sent wrong amount.

- Request to resend details such as eGC number and passcode if you did not receive any SMS.

Note: Once cancelled, your funds will be credited back to your source account.

Frequently Asked Questions

- Can I withdraw my eGiveCash from any ATM? This is only available at Security Bank ATMs with eGiveCash. For the full list of ATMs with eGC, click here.

- How much can I send through eGiveCash? You can send from P500 up to P10,000 per transaction (in denomination of P100). Please note that there is a monthly cash limit of P50,000 per mobile number.

- Does eGiveCash expire? What will happen if I am not able to withdraw? A pending eGiveCash transaction is valid for 14 calendar days. Once expired, the transaction will be automatically reversed and the amount will be credited back to the sender.