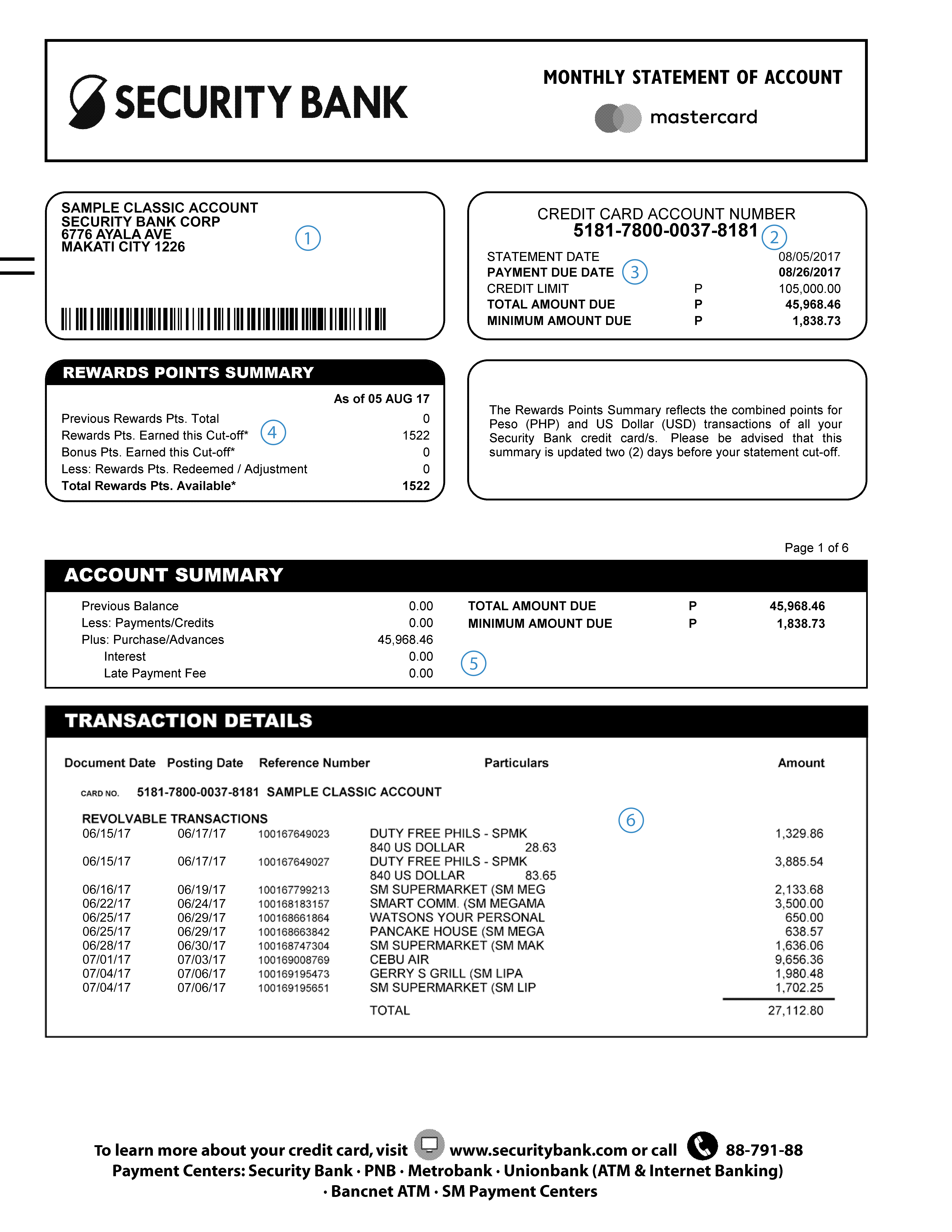

- Billing Address

- Card Number and Statement Date

-

Payment Due Date - Payment must be received no later than this date. Credit Limit – Total Amount of what you can spend on your credit card.

Total Amount Due – Total balance payable to your card.

Minimum Amount Due – Minimum amount that can be paid to avoid the account from going into default. - Rewards Points - Summary of your rewards

- Account Summary - Summary of your payments and purchases made throughout the statement period.

- Transaction Details - List of all your transactions for the current statement period.